How Verve anticipates market volatility (so you don’t have to)

by Verve

Thinking about investing but worried about the market’s ups and downs? Here’s the thing: market downturns, turbulence and volatility are normal parts of investing. Here at Verve Money, we’ve designed an investment strategy acknowledging that market volatility is a normal part of the process.

That’s why we give investors (like you!) the choice of three different ethical investment portfolios, with varied risk and return profiles accompanied by suggestions of differing minimum investment timeframes. The investment portfolios can include investments listed on stock exchanges (i.e., shares) and other ‘off-market’ investments that aren’t as subject to market volatility (like our investment into a renewable energy-focused fund). This diversification can also help to reduce the impact that market fluctuations may have on you being able to reach your money goals.

What is market volatility?

In a nutshell, market volatility refers to dips, spikes or changes to the value of companies or products that happen over time.

For investors, a good indicator of when market turbulence is occurring is when your investment account experiences a large, unexpected drop or spike in value.

So why does this happen?

Financial markets often experience uncertainty in response to major economic and political events, from whispers of a recession to drops in consumer confidence and even the outbreak of disease (like we saw at the start of the COVID-19 pandemic).

While market ups and downs can be stressful for investors, it’s important to know that this is a normal part of investing and something that experienced investment managers plan for.

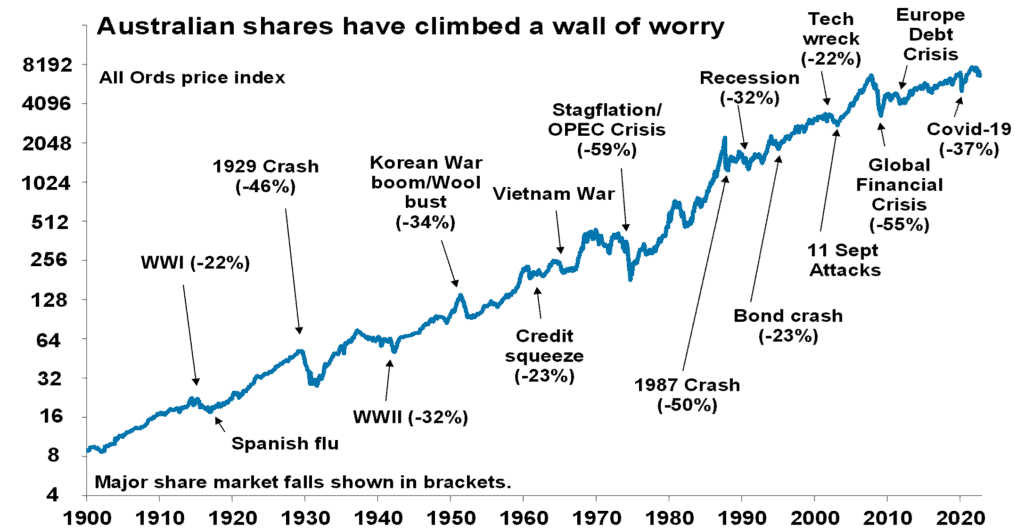

The good news is, that ever since the beginning of Australia Stock Market history, we can see that although there have been some periods of huge downturns, the market has always rebounded. Interestingly, the greatest gains are also often after periods of significant losses, hence why many experienced investors will actually start buying up more stock at exactly the moment that inexperienced investors are often thinking about selling.

Here’s a graph that shows how the Australian All Ords Index (a tracking of the price of Australia’s top companies listed on the ASX) has performed since the 1900s, certainly some worrying moments, but always with rebounds.

Graph source: AMP

How Verve Money addresses market volatility

At Verve, we approach investing with market volatility in mind, constructing portfolios that are designed to meet your needs.

Variety of diversified portfolios

Our growth-focused investment portfolios include a mix of traditionally stable assets like bonds, fixed-income assets and domestic and international equities, often held through Exchange Traded Funds (ETFs), and alternative impact investments that aren’t listed on the stock exchange and are typically hard to access as a standalone investor, including green energy bonds and renewable energy funds. This provides strong diversification and means that even when the share market is rocky, there are investments in our portfolio that will be less affected or not impacted by the volatility at all.

Want to learn more about our portfolio types? Check them out, here.

Designed with market ups and downs in mind

Inevitably, the value of investments in your chosen portfolio will change over time. Certain investments grow at a faster rate than others, which can disrupt the balance of the allocation of different investments.

In recognition, Verve will adjust the investment portfolios to restore the balance and deliver the right amount of diversification. This ensures the level of risk you’re comfortable with for your investment strategy remains in line with your money goals.

Experienced investment managers

Our investment management team has over 30 years of experience and monitors major market movements continuously. The team is focused on identifying assets that have a high probability of matching the portfolio performance objectives. We’re not predicting the future, we’re taking calculated risks in financial markets that, based on historical projects, we believe will see our investors rewarded over time.

What to remember about market fluctuations

Here are some tips and tricks to get you through those uncertain times when there are periods of high volatility.

- Tip 1: Think about the reason you started investing and take a closer look at your financial goals. Then look at the graph we provided above. If your goals are a long way in the future, then there is time to make up for dips in your balance today – looking at how the share market has behaved historically puts volatility into perspective.

- Tip 2: To make informed investment decisions, it’s important to grasp the relationship between risk and potential reward, as higher risks often correspond to higher potential returns, while lower risks tend to offer more modest returns.

- Tip 3: Try not to check your balance too regularly and be careful not to make rash decisions. If your goals are years away, then we advise you to consider checking the performance of your investment every quarter or so (certainly not every day). Remind yourself that when you’re investing for the long term with Verve, we’ve designed our investment portfolios to anticipate market volatility.

Ultimately, stock market fluctuations are a part of the economic cycle. But, ethical investing apps like Verve Money are designed with market volatility in mind, giving you access to diversified portfolios that balance risks and support your long-term money goals.

Ready to start investing with a diversified and sustainable investment portfolio? Sign up to Verve Money and download our app from the App Store or Google Play today.

This website contains general information only, and does not take into account any one person’s financial objectives, situation or needs and accordingly does not constitute personal advice for the purposes of section 766B(3) of the Corporations Act 2001. Consider whether the information provided is appropriate for you and whether you should seek advice from a professional adviser.

Interests in the Verve Money Fund (ARSN 662 622 899) were issued by Melbourne Securities Corporation Limited (ACN 160 326 545, AFSL 428289). The Verve Money Fund is now closed.

The content of this website is current at the time of publication and may be amended or revoked by the Fund Manager or the Trustee at any time.